Unpacking Stakeholder Governance

Our planet and its inhabitants are crying out to protect and restore its natural beauty and its life giving resources.

Success of the EU’s proposed Green Deal depends on businesses considering the planet as a stakeholder. Without a vibrant planet, we cannot support healthy communities nor can we sustain business.

Moreover, people’s livelihoods depend on fair treatment, open access to opportunities and respect for the impact of business on their communities. By intentionally placing society as a stakeholder, the social contract between business and society can be repaired.

Placing Directors’ Duty of Care in Stakeholder Governance

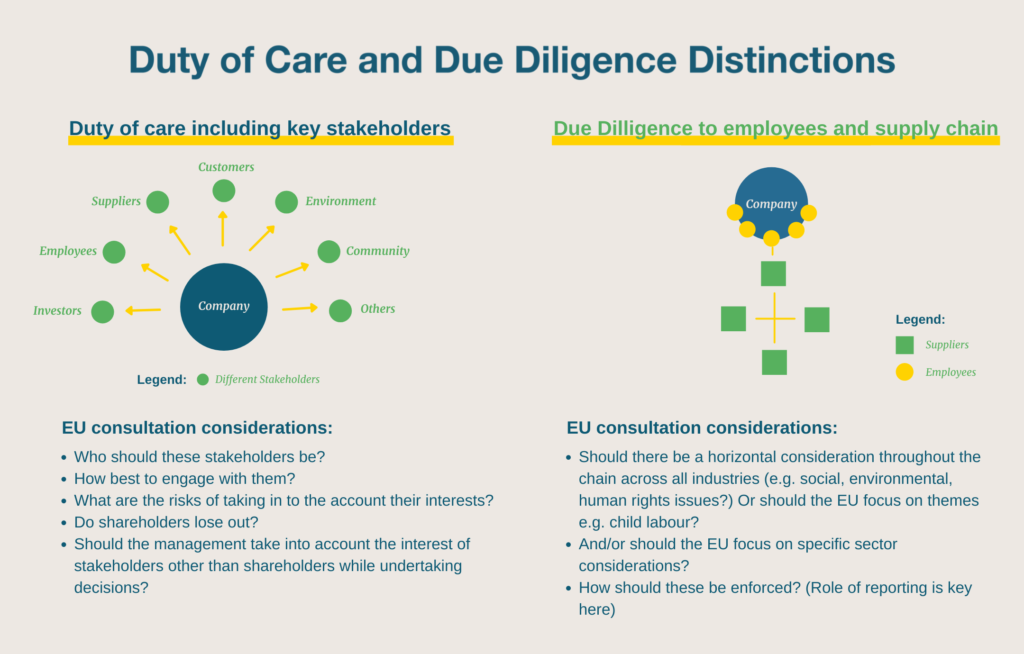

The European Commission’s consultation on Sustainable Corporate Governance focused on two key areas: Duty of Care of managers of companies and the Due Diligence of a company on its suppliers.

We can define stakeholders as all those who either contribute to, and/or are affected by the business and therefore have a “stake” in it.

While the idea that companies are responsible for their impact on the world may seem like a no-brainer in this day and age, there is resistance, confusion, concerns and some fear to such a proposal.

Our challenge: Dominant business thinking remains profit-led, and the language around stakeholder governance and what it might mean for leadership’s own liability isn’t so clear.

To address these concerns, we need to prove that stakeholder governance is possible, beneficial in the long-term, and that there are best practices for implementing it.

Common Myths About Shareholder Primacy

There is no conflict between shareholder primacy and sustainable and responsible governance, because in the long term, the interests of stakeholders and shareholders coincide.

Whilst this may be true, it does not mitigate the need to understand the impact of decisions on all stakeholders, and make a balanced decision on how to manage conflicting interests in the short to medium term. A company needs to reach the long term for this to be the case.

- McKinsey study shows average corporate life span has been falling for more than half a century: Standard & Poor’s data show it was 61 years in 1958, 25 years in 1980, and just 18 years in 2011 and is now nearer 12 years.

- For example, consumers may need to pay higher prices for products and services that have less negative impact on the environment.

Directors have sufficient flexibility under the “business judgment rule” to address any concern they have, but they would be unable to elevate stakeholder interests over those of shareholders.

Yes, they do have sufficient flexibility in most European company law to act in the interest of stakeholders, but they are not obligated to do so. This creates an uneven playing field, and a weak collective effect. For the climate targets of the European Union and its member states to be met, we need a clear mandate expressing that the Directors’ Duties obligates, not just enables directors to consider the interests of all those affected by the operations of the business.

- Professor Jaap Winter’s paper proposes a duty of societal responsibility should be imposed on the board of the corporation. “Taking away shareholder discipline and not replacing it with something else, leaves corporations with effectively non-accountable directors.”

Creating corporations that specifically are designated as stakeholder friendly will give greater license to traditional corporations to act irresponsibly, and create negative impacts on society and the environment, powered to advance the interests of their shareholders at the expense of wider society and the environment.

Are you familiar with the “Don’t mandate good because the bad guys will get worse” argument? This is why it is important that all businesses need to operate under the same considerations of stakeholders’ interests, to avoid the “free – rider” problem. Whilst voluntary adoption of stakeholders’ interests has proven that all benefit in the medium to long term, the 6,300 B Corps and 10,000 benefit corporations across the world cannot single handedly change the outcomes on our existential crises. A relatively small number of companies acting irresponsibly are damaging the future impact for everyone; taking these companies to court one by one is slow and ineffective way of creating the change needed.

- Carbon Disclosure Project study reveals just 100 companies contribute to 70 % of all emissions

- The recent Shell judgement shows the risks are now open to all companies that they are not protected by existing directors’ duties from the obligation to act responsibly.

Stakeholder governance cannot work, because there are too many interests for corporations to reconcile; this will allow managers to simply act in their own interest, because there will be no clear standards.

This is why the standards have to be created alongside the obligations and the Directors duties all need to be clarified. The legislation for corporate governance needs to be aligned both with investors’ obligations and with companies’ reporting requirements alongside standardised aligned metrics.

Shifting from shareholder primacy to stakeholder governance will harm shareholders through “trade-offs” between stakeholder and shareholder value.

As we have seen through a series of studies, the shareholders benefit when stakeholders benefit. The value of a company is intrinsically linked to the value placed by those stakeholders that contribute to its success.

- Colin Meyer – 2018. The wider purpose of the corporation is framed in the context of the contribution that the corporation makes to wider society, to people and to our planet. Profit is not the objective of the corporation as such but is one outcome of this process in which the corporation seeks to be valuable to society.

- HBR study: Various studies revealing benefits from sustainability practices through lower cost of capital, higher morale in such companies led to lower rates of turnover, and greater demand for products from customers. This is supported by Edelman data, FT findings, and other macro analyses.

- Edelman Trust Barometer reveals expectations of business by society: 68% of respondents expect CEOs to fill the void left by the government in fixing societal problems, while 65 percent feel CEOs should be as accountable to the public as they are to their shareholders.

But how do stakeholder governance and management work in practice?

- Measuring stakeholder impact that is not the responsibility of directors or valued by investors will result in the standardized reporting of the failure to create stakeholder value.

- Developing a culture of interdependence not reflected in stakeholder management and governance is wishful thinking and sloganeering that ignores incentives and power.

- Adopting stakeholder governance without management systems and the culture to reinforce progress will amount to little more than glorified mission statements.